Investing in Real Estate – My Story

The Realities of Investing in Real Estate in Perth with Centurion’s Director and Property Expert -Justine Valender

For most millennials I know, the dream of homeownership doesn’t just feel far away, but sometimes nearly impossible. So, I’d like to share my personal journey of purchasing my first property in High Wycombe. I’ll walk you through the steps I took from buying and renovating the property, to subdividing it and ultimately transforming it into a successful investment.

After many years of saving and sacrifice, at the age of 26, I was able to finally get on the Perth property ladder. I did this through the ‘first Home Buyers Grant’ and with the help of a great mortgage broker, great real estate team, and saving every penny I could.

I believed that homeownership was one of the most effective means to accumulate wealth. Especially if I could add value through renovation and subdivision.

I asked myself:

“What is my WHY ?”

* To make 50k in one year.

* To step outside my comfort zone

* Utilize my skills, and leverage from the experience of others

“Why Subdividing as a Strategy?”

*Very hands-on, some capital outlay required for approvals

*Can be more profitable, the risk involved with site selection, while waiting to develop have lower rent-paying of a tenant, more maintenance, lower rental yield.

* Find a property that I could make a profit and add quick value

After attending many seminars, researching, speaking to people who have completed subdivisions, I knew I wanted to open my mindset and purchase an “older style home”. I could buy in an area located close to amenities, airports, hospitals, schools, and shops and then renovate and subdivide down the track.

High Wycombe has always been a popular suburb in Perth, this mixed in with the zoning changes and a high rental yield at the time, led me to search for a property in this area.

61 Cyril Road, High Wycombe

(House and Block)

My Age: 26

Year purchased: 2012

House cost: $350,000

Down payment: $35,000

After a period of time, researching the market, doing my due diligence, and calculation on each property. I purchased 61 Cyril Road, High Wycombe.

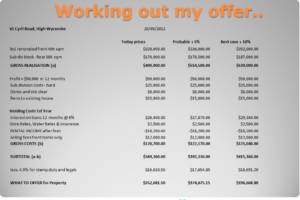

The property was on the market at $370k, through reverse pricing strategy (example below) I knew I had to offer $355k to make the projected profit

The property was a straight forward “retain the front house and subdivide on the back” scenario. The original 3×1 house was built in 1965 and situated on 837sqm.

The house required a full paint, floors sanded, carpets removed, laundry retiled and new kitchen fitted and some gardening. We budgeted $7k for renovating.

Front house sale (3×1)

I also wanted to renovate and get as much work done before the property settled.

I, therefore, put a clause in on my “Offer & Acceptance” That once the property was “Unconditional” I had the approval to enter the property for the purpose of renovating.

(Essentially voiding any final inspection on the property)

The 21 day period to settlement allowed me to enter the property and start works without the holding cost.

This allowed me to rent the property out at $400pw within 4 days of the property settling. The High Wycombe rental market was very strong at this point.

(As we obtained the first home buyer grant, we did move into the property after 12 months for a period of time)

We then started the subdivision work to the rear of the property and put the front house on the market.

We had titles issued at Landgate and put fences up, so we could sell the front house.

My Age: 28

Year Sold: 2014

(front house) Sale: $363,00

Sale Cost:$7,260

Sales Agent: Andrew Fisher

Subdivision (4×2)

My Age: 28

Year Built: 2014

Build Cost : $201,762 (finished $220,000)

Rented: 12 months at $470pw

After a successful sale of the front house with Andrew Fisher. We were essentially left with a 386sqm block of land to the rear, that we did not have a mortgage on. It was only once we engaged a builder to build a 4×2 house that we obtained a mortgage of $201,762

We rented the back “new” property for 12 months at $470pw. Again, the rental market in Perth was still performing well at this point. We were advised to hold onto the property for 12 months, to help minimize our capital gains.

As I worked in property management, I also had a great team that looked after both my rentals, local to High Wycombe.

After 12 months and the market started to decline, we put the property on the market for $470,000. 6 months prior, similar properties were selling at $500,000. However, this was the start of the Perth market decline. We eventually sold at $442,000 in July 2016.

The journey has been a rollercoaster, but overall very successful. I’m open to sharing my mistakes, to help my clients avoid any costly pitfalls they may come across. But I’ve also made some great gains through property investing.

Sold: 2016

Sold Price: $442,000

Debt: $201,000

My Age: 30yrs

Sales Agent: Andrew Fisher

Successful Property Investment

Is about “making money out of property”. Unlike buying a home, an investment property purchase should be the result of careful consideration of how a property meets your investment objectives and how the property will perform as an investment.

This may seem obvious, but a good investment property needs to perform as an ‘Investment’, meet your objectives and attract long term quality tenants, low maintenance, low vacancy period, high depreciation.

Investing in property is a big decision that can keep even the most seasoned property investor awake at night.

How do you know if you’ve got your investment strategy right? How can you make sure you’re choosing the right property? Where can you find the time to do the necessary research? What is the right price to pay?

INVESTORS CARING FOR INVESTORS.

As you have read my story above, I didn’t just learn it from “A book”, my experience is real ‘hands-on’ and I understand the challenges facing our investors in today’s market.

I want to help YOU make the right decision….

Our FREE Property Investment Analysis includes:

- Providing a free rental market appraisal on any ‘potential’ investment properties you may be looking at.

- Offering suggestions tips, tricks to insert into the Offer & Acceptance to help minimize the vacancy period.

- Compliance check, on the property. i.e does the property meet ‘minimum security requirements’

- will attend the final inspection as a second pair of eyes and work on your behalf.